Right now, the price of Bitcoin is soaring through the roof. Maybe you heard last week that 1 BTC was trading $10,000. Yesterday your friend told you that it had breached $15,000 and it showed no signs of slowing. Now you’re thinking - if I had invested even $100 last week, I’d be up $50 right now. As an investor, this is one of the worst feelings - the knowledge that you’ve missed out on an opportunity. It might even feel like you’ve lost $50. That’s something both of us have in common, I’ve never invested in Bitcoin either.

So the question is - do we jump in now? Let’s look at it carefully.

What the hell is Bitcoin?

Thought you’d never ask. There are two related concepts here - Bitcoin (aka BTC) and the Blockchain. Bitcoin is a digital currency and the Blockchain is the technology that powers it.

Let’s look at a traditional transaction first. If you wanted to make a payment with a debit card, your bank decides whether the transaction goes through or not. You swipe your card, and Mastercard/Visa contacts the bank to ask if you’re good for the money or not. Your bank looks at all of your transactions, adds up the debits and the credits and if you have sufficient balance, the transaction will be approved. A new transaction is added to your list of transactions.

Could we design a payment system without a central authority like the bank? Suppose a bunch of us got together and decided

- We’ll all keep a list of every transaction that happens in our network.

- We can figure out anyone’s balance by adding up all the credits and debits to their address on our network.

- To allow a new transaction, the majority of us have to agree to add it to the list.

This is great! With one tiny issue - how do we decide the majority? If it’s based on voting, that’s a problem. An attacker could create a bunch of fake accounts and control the voting - they could prevent certain transactions from taking place at all, or they could add fraudulent transactions. Yes, such behaviour would completely undermine the system but the attacker doesn’t really care. Creating the fake accounts hasn’t cost them anything, after all.

Could we limit the voting to only those who actually care about our currency? Yes, and that’s exactly what the Blockchain does. The Blockchain requires people who want to confirm transactions - the miners - to do some work before they can add a block of transactions to the chain. This “work” is solving a puzzle. It’s usually a puzzle that’s difficult to solve but requires a lot of computers burning a lot of electricity. This requirement means that the miners have to invest large sums of money in computing hardware and electricity - they now now have skin in the game. Of course, we’ll compensate the first person to solve the puzzle for a block with transactions fees and a special “mining” fee for taking the trouble of solving the puzzle.

Yes, we’ve now created a decentralized currency. To recap:

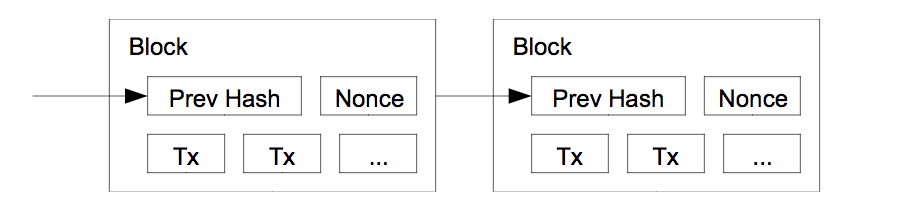

- Everyone has a copy of all the transactions that have taken place - the chain of blocks.

- Anyone can submit a new transaction, provided they have money in their Blockchain address.

- Once there are sufficient candidate transactions, miners start solving the puzzle. The input is the candidate block.

- Once the first miner solves the puzzle, other miners add the block to their local copy of the Blockchain, provided it contains no obviously fraudulent transactions.

- The miner gets the transaction fees and the mining fee, in the currency we’re mining.

- All the miners now move on to the next set of transactions and begin solving the next puzzle, i.e., mining the next block. The new candidate block contains an identifier (aka hash) to the recently solved block - this is the link in the chain.

An attacker can’t add fraudulent transactions because other miners wouldn’t accept it. Only other miners can accept newly mined blocks - because only they have the capability to “build on” the recently mined block. A block is only considered a part of history if all miners have accepted a block and have built at least 2 blocks in succession after it.

What if all the miners got together and decided to transfer your money to one of their friends? They could add the fraudulent transaction in a block and continue to build on that shady block. They could… but they’re compensated in the currency itself - so they have every incentive in ensuring the integrity of the network. If they committed fraud, people would lose faith in the currency and their current and potential earnings would be worth nothing.

We have solved fraud. Everyone is happy.

So Bitcoin is a currency?

There’s a nuanced answer here - the Blockchain certainly has the capability of creating a decentralized currency. Bitcoin is the first attempt at creating a currency based on the Blockchain technology. Its the best known crypto currency, the one that grabs all the headlines.

But currencies have a few important properties

- Their value doesn’t fluctuate much. This is important because otherwise you wouldn’t feel comfortable keeping your savings in the currency. If you thought the value of your savings was going to drop, you’d be converting your savings to another currency real quick.

- They are widely accepted. If I have a note in the currency of a country and I happen to be in that country, its easy to find a merchant who will accept it. Similarly, if you have a debit card you can spend it nearly anywhere.

- Transaction fees are non existent (cash) or low (cards).

- Transactions are fast. Transactions take place immediately (cash) or quickly enough (cards).

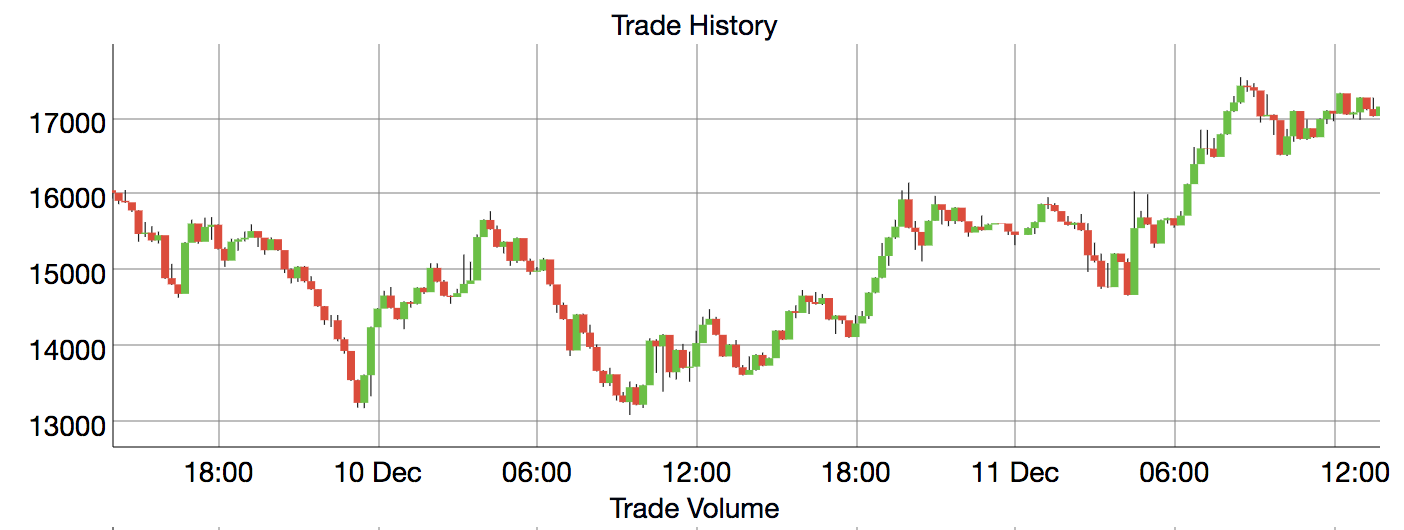

Bitcoin is none of these things - its value fluctuates wildly. In the last two days alone its reached a high of $17k and a low of $13k. It lacks stability. I can’t think of very many people who would be comfortable getting their paycheck in Bitcoin - it’d be impossible to guess exactly how much money you’d receive at the end of the month.

Very few merchants accept Bitcoin, and that number is shrinking. Steam, the largest marketplace for video games was an early adopter, but recently stopped accepting bitcoin payments. The volatility of Bitcoin meant that its value would change before the transaction went through. Right now, almost no one is buying Bitcoin to spend on goods and services, because very few merchants accept it.

Bitcoin’s transaction fees are high - around $3-5 for every transaction, regardless of the value of the transaction. Its also been as high as $25 at times. This makes low value Bitcoin transactions not worthwhile. It also makes refunds nearly impossible - imagine asking for a refund for a $50 game when you have to pay a $25 transaction fee twice.

Lastly, it takes around 8-10 minutes for a block to be mined. If you’re willing to pay the going transaction fee at that instant, you might make it to the first or second block. If you’re stingy it could take several hours for your transaction to appear on the blockchain. This is unlikely to change regardless of the resources we throw at mining. In fact, it will get slower as the transaction volume increases. Therefore, a Bitcoin transaction will never be as fast as a card transaction, which is usually under 2 seconds.

So it’s not a very good currency at all. Unless these problems are fixed, that’s not going to change.

So Bitcoin is an asset?

In the early years I used to hear of Bitcoin users who actually bought games from Steam, electronics from Newegg and drugs from shady websites. Nowadays I only hear of Bitcoin investors, who are ploughing money in with the hope that the value of Bitcoin goes up. So yes, Bitcoin today is an asset.

What’s the value of this asset? In my opinion, if its not a currency, then it has no intrinsic worth. It has a high price right now because people are buying it regardless of the price, thinking/hoping it will go up in value.

In many ways it is similar to the Dotcom bubble - people invested vast sums in silly ideas, thinking they would succeed simply “because internet”. People today think that Bitcoin will succeed “because Blockchain”. The technology in both cases is unfamiliar enough that people can’t intuitively tell what the correct value should be, just that its value is rising and they should invest before its too late.

When the price of an asset outstrips its value, it’s a financial bubble. Bubbles eventually burst. People lose money.

Conclusion

So you’re saying I shouldn’t invest in Bitcoin, because it has no value and this is a bubble?

No, that’s not what I’m saying. See, you and I are fools for considering an investment in an asset that’s worthless but costs so much. But we could invest now at $15k in the hope that there will be a greater fool who will buy from us at $18k or so. As long as we were reasonably confident that enough greater fools exist, we could invest now and make a decent chunk of money. Many people have done exactly this.

So, you should invest if you’ve done the math and decided that there are enough greater fools to push the price higher and higher. Or if you’re confident that you’re lucky enough to exit before the inevitable crash takes place. Or if you just love the adrenaline rush from gambling.

But if you’re like me and you can’t make a good estimate of the number of fools out there, and you have 0 faith in your luck and low appetite for risk, then you should probably sit this one out.

It’s also possible that Bitcoin’s problems could be fixed in the future, that the value stabilizes and it becomes a viable currency. In that case, it has intrinsic value. If you think this likely (I don’t think it is), then you could make a bet now that it will be worth something in the future.

Edit (21/12/2017): I came across this explanation by Ashwath Damodaran, a professor at NYU that’s far superior. He goes into detail about the difference between trading and investing, a distinction that’s important to make in this context. I stand by what I’ve said about how bitcoin works and its utility as a currency, but my analysis of its long term value is simplistic to the point of being misleading. You should definitely read what he has to say about valuing and pricing Bitcoin. Professor Damodaran and I are agreed on one thing though - you need trading skills, not investing skills, to succeed while dabbling in Bitcoin.

Epilogue

I think the Blockchain is a fundamentally great technology. It has the potential to enable ideas that were difficult to imagine before. Amongst the other currencies based on the Blockchain the most interesting one is probably Ethereum, because of how it enables automated contracts. I’m not going to speak too much about these because my knowledge of alt coins is limited, but I encourage you to check them out.

Notes

- The original paper by Satoshi Nakomoto. Short and readable.

- Bitcoin and Cryptocurrency TechnologiesI learnt the nuts and bolts of how Bitcoin works from this book. Its accompanies their Coursera course.

Thanks to Chandra Sekar, Aman Agarwal and Tom Weightman for reading drafts of this article and suggesting improvements.